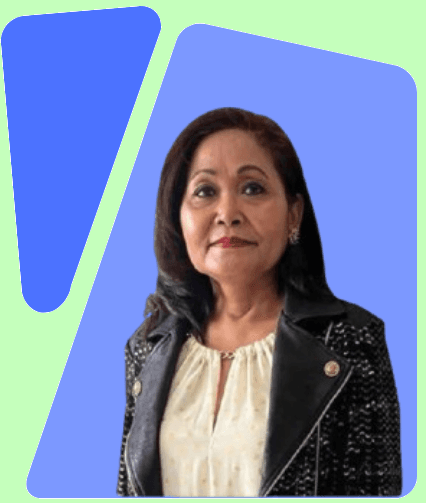

Maria Liza Friesen

Need to grow your money?

Secure your future with comprehensive insurance and investment solutions

Book a Call

Why trust

our services

Registered And Licensed Financial Advisor

Managing Broker under Greatway Financial

Licensed in big Canadian cities

Alberta, British Columbia, Ontario and Manitoba

Partnered with many financial services

- Ivari

- CPP (Canada Protection Plan)

- Foresters Financial

- Equitable Life

- TruStage

- BMO

- Edge Benefits

- Insurely

- Credit Lift

- Cooperators

Finance Insights

Services

Insurance

- Life Protection

- Critical Illness and Disability Insurance

- Health and Dental Insurance

- Travel and Super Visa Insurance

- Visitor Visa Insurance

- Group Benefits and Business Insurance

- Mortgage Insurance

- House Insurance

- Term Insurance

Investments

- RRSP

- RESP

- TFSA

Book Now to Learn More!

Wealth Creation

- Self Employment Opportunities

Book Now to Learn More!

We can't wait to see you grow

For any questions about our services, please reach out to

ma.liza.friesen@mygreatway.ca

or call 604-378-2240

Copyright 2025. Made by f8 solutions.